Four Forces of Flight and Financial Planning

Early in flight training a student pilot learns about the four basic principles of flight. It is usually asked as a question of what makes an airplane fly? While there are many complicated factors at play with the aerodynamics of flying an aircraft, flight can be reduced to four main forces: Lift, Weight (gravity), Thrust and Drag.

As a Certified Flight Instructor, I often pose the question of what makes an airplane fly to students early in the training process. After some thought and consternation, they can usually come up with a couple of the four principal forces. I then respond, no its actually ‘Money’ that makes an airplane fly. We both laugh and understand the reality of this. With financial planning, it’s also money or income that makes retirement successful.

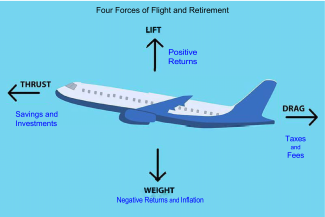

We can use the airplane model of principles of flight to explain concepts within financial and retirement planning, especially with our investments.

In the airplane model, lift is created by the differential variation of air pressure on the plane’s wings, which causes the plane to rise. This force is countered by weight or gravity which acts to pull the airplane down. Forward movement is provided by sufficient thrust. This force is countered by drag, which is a result of friction. In level flight, all forces are balanced.

In this analogy, we can see that thrust has been replaced with savings and investments (creating wealth), drag with taxes and fees, lift with positive returns, and weight (gravity) with negative returns and inflation. As with flight, we see the opposing relationships between pairs. As one accumulates wealth and moves forward with a retirement strategy, eventually there will be taxes and fees, even if they are relatively minor compared to the overall movement forward and are easily overcome. Positive returns compound on accumulated value, like lift for the aircraft, they are countered with negative returns and inflation that pull the aircraft, or financial plan downward.

These are not hard and fast analogies, but touch upon different external forces in retirement income planning. The importance of keeping your financial strategy “aloft” drives home the hard value of a strong retirement plan. In this diagram, it is not enough to get in the air; financial and retirement plans need to be sufficiently structured for all the phases and risks of flight to fly further and higher.

Personalized Financial and Retirement Planning That’s “Right for You”

Specialists in Retirement and Estate Planning

👉 Get Started

|

Richard Goselin, Registered Investment Advisor |